Caixin Insight: Focus on Consumption

Why is consumption still falling?

Despite China’s quick containment of the Covid-19 epidemic and rapid return to work, the rebound in consumption has slowed to a stall over the course of the summer. It is now constraining demand and limiting the larger economic recovery.

Wang Xiaolu, deputy director of the National Economic Research Institute, drew attention to the issue in a recent speech, (link in Chinese) highlighting widening inequalities in income and consumption.

One factor behind the lag in consumption, which some may find surprising in contrast to otherwise relatively rosy economic data, is that conventional statistics aren’t really reflecting the reality. Wang brings up three key issues. The first is fairly well known, particularly following economist Li Xunlei’s famous paper on it earlier this year: the statistics are bad. Wang notes:

- conventional industrial statistics only reflect larger companies, which are not the primary employers

- there are eight times as many small companies as large ones reflected in the statistics, and they face far greater difficulties, especially in the service sector

- unemployment data is lacking

- urban unemployment, which stood at 5.7% in July, is defined as “working less than one hour a week;” if measured by “working less than 10 hours,” the rate could double

- those not counted as unemployed may be earning just 10% or 20% of their normal monthly income, and migrant workers who returned to the countryside after losing their jobs aren’t counted either

The second issue is that the social security net has holes, so many unemployed or under-employed workers have not been given due protection.

- despite top-level political focus on the “six guarantees,” only a fifth of China’s officially unemployed people received unemployment insurance in jobless claims

- unemployment insurance covers only 200 million of China’s 440 million urban workers, most of whom are migrants who cannot receive it because their hukou is not registered in the same city they work

Third, poor economic performance has generated income uncertainty, encouraging low- and middle-income people to save more and consume less. This creates a vicious cycle, by constraining purchases from the small and micro businesses they support, further affecting employment, income and consumption.

How should policy respond to this? Beyond the obvious suggestions to protect employment, provide social security, and relieve pressure on companies, Wang rails against governments’ myopic focus on investment. “In Beijing, for example, many otherwise intact roads are being dug up and repaved. Investments like this are inefficient and a waste of resources and should be stopped as soon as possible.” He says:

- China’s investment rate is too high, more than twice the world average at 43%, and consumption rate is too low, far below the world average at 39%

- the problems discussed above have not been addressed for a long time, and hold back domestic demand even in good times

- fiscal policy needs to address low and middle-income people’s livelihoods, and the government should cut all the red tape and use big data to identify the unemployed and help them

- local governments should use all the debt they’ve accumulated for investment to expand the supply of affordable housing

- the market environment needs to provide an even playing field for small, medium and large enterprises, whether state-owned or private

State Council promotes “new-style consumption”

Perhaps Li Keqiang heeded Wang Xiaolu’s words, because yesterday’s State Council meeting called for measures to accelerate development of “new-style consumption.” There is no doubt that consumption is an important engine of economic growth, and the “dual circulation” strategy has put a spotlight on it. Unfortunately for Wang, however, the State Council meeting remained characteristically focused on investment, rather than income redistribution, promoting “new-style consumption infrastructure,” which overlaps heavily with normal “new infrastructure.” It prioritizes:

- 5G

- internet of things

- “gigabit” cities, which we can only assume are even-smarter smart cities

- digital upgrading of rural trade

- smart logistics

- commercial use of consumption data

- innovative measures to reduce the cost of mobile payments, etc.

To be fair, the meeting also called for improvements to the market environment by cutting red tape, for companies to promote consumption with more online sales, better enforcement of consumer protection, strengthening of labor protection, and other measures, but in much less detail.

Regardless, it’s worth keeping an eye out to see these plans get fleshed out in greater detail, as their implementation will be a key make-or-break factor in China’s continued growth and economic recovery from Covid-19.

Inflation data digest

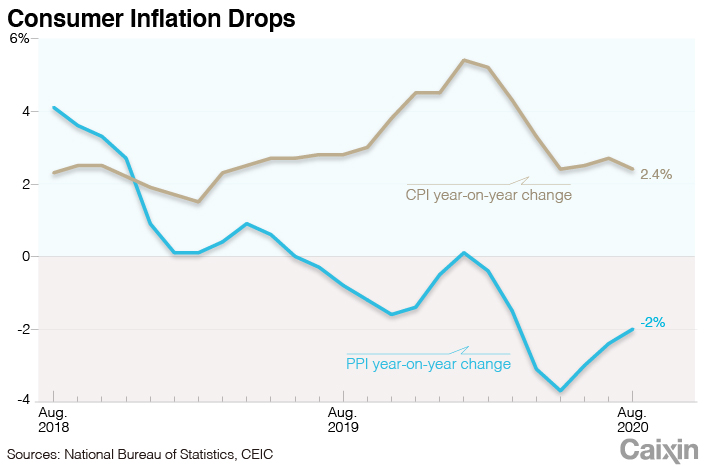

China’s consumer price inflation moderated to 2.4% year-on-year in August, 0.3 percentage points lower than the previous month due to the higher base and weakening food price inflation.

Food prices rose 11.2% year-on-year in August, moderating from 13.2% in July. The fall in CPI inflation was mainly driven by a sharp decline in pork price inflation, which eased to 52.6% in August from 85.7% growth in July. However, the prices may not continue falling as they did last month, as demand continues to increase along with supply. Vegetable prices, impacted by a combined heat wave and heavy rainfall, jumped 11.7%, compared with a 7.9% increase in July, mitigating the impact of cheaper pork.

|

Otherwise, “core inflation remained unchanged at a very low level of 0.5% year-on-year in August, thanks to a sharp fall in crude oil prices which have a material impact on the prices of many final products,” said Nomura's Chief China Economist Lu Ting.

On the production side, PPI fell 2% in August, illustrating the continued recovery from Covid-19, albeit more slowly than July’s 2.4% decline. Dong Lijuan, a senior statistician with the National Bureau of Statistics, said “industrial production continued to improve while market demand kept recovering in August." She also added that "prices for global commodities such as crude oil, iron ore and non-ferrous metals continued to rise, driving a rebound in domestic factory-gate prices."

Exports grow at fastest pace in 17 months

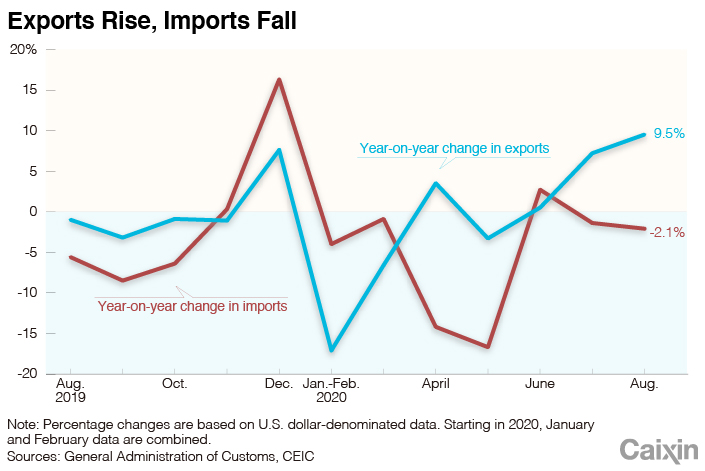

China’s dollar-denominated exports grew at 9.5% year-on-year in August, accelerating from July’s 7.2% growth in the fastest expansion since March 2019, boosted by recovering overseas demand and shipments of medical supplies to countries battling Covid-19.

Exports of medical equipment grew 38.9% year-on-year in dollar terms in August, slower than the 78% increase in July, but still well above average. Shipments of textiles, including facemasks, rose 47% last month, though economists expect the momentum will slow in coming months as other countries resume production. Electronics like computers and mobile phones also performed well amid the rise in remote work and study. Export growth in such products might be more resilient than in other categories, as around 55% of respondents to UBS Evidence Lab’s PC consumer survey said they were willing to buy computers over the next six months versus 51% in February.

|

Imports, however, declined for a second straight month, down 2.1% year-on-year in August, steeper than the 1.4% decline in July. However, the drop-off in imports was due largely to low commodity prices and the high base of last year; import values will likely soon begin expanding again, as China accelerates the pace of infrastructure investment and works to meet its phase one trade deal commitments.

While China has increased its imports of U.S. corn, soybeans and other products in the past few months, purchases have fallen far short of what would be needed to meet the targets. It is unlikely that China will be able to hit them: in the first seven months of this year, China’s purchase of U.S. products was only around 47% of its year-to-date target, according to Peterson Institute for International Economics (PIIE), or 27% of the 2020 goal.

Download our app to receive breaking news alerts and read the news on the go.

- 1Cover Story: China’s Balancing Act to Keep Its Social Security System Afloat

- 2Exclusive: CATL Founder Upbeat About Ford Battery Plant Tie-Up, EVs Future in China

- 3China’s Macro Leverage Ratio Rises to 294.8% Despite Slower Borrowing

- 4Shanghai Creates $18 Billion State Investment Giant

- 5U.S. Lawmakers Seek Sanctions on Chinese Carmakers for ‘Aiding Russian Military’

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas